Sharpen Your Knowledge with PRMIA PRM (8006) Certification Sample Questions

CertsTime has provided you with a sample question set to elevate your knowledge about the PRMIA Exam I: Finance Theory, Financial Instruments, Financial Markets – 2015 Edition exam. With these updated sample questions, you can become quite familiar with the difficulty level and format of the real 8006 certification test. Try our sample PRMIA Exam I: Finance Theory, Financial Instruments, Financial Markets – 2015 Edition certification practice exam to get a feel for the real exam environment. Our sample practice exam gives you a sense of reality and an idea of the questions on the actual PRMIA Professional Risk Managers certification exam.

Our sample questions are similar to the Real PRMIA PRM 8006 exam questions. The premium PRMIA Exam I: Finance Theory, Financial Instruments, Financial Markets – 2015 Edition certification practice exam gives you a golden opportunity to evaluate and strengthen your preparation with real-time scenario-based questions. Plus, by practicing real-time scenario-based questions, you will run into a variety of challenges that will push you to enhance your knowledge and skills.

PRMIA 8006 Sample Questions:

It is October. A grower of crops is concerned that January temperatures might be too low and destroy his crop. A heating-degree-days futures contract (HDD futures contract) is available for his city. What would be the best course of action for the grower?

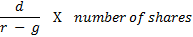

According to the dividend discount model, if d be the dividend per share in perpetuity of a company and g its expected growth rate, what would the share price of the company be. 'r' is the discount rate.

A.

B.

C.

D.

If the CHF/USD spot rate is 1.1010 and the one year forward is 1.1040, what is the annualized forward premium or discount, and the one year swap rate?

A currency with a lower interest rate will trade:

By market convention, which of the following currencies are not quoted in terms of 'direct quotes' versus the USD?

Note: If there is any error in our PRMIA 8006 certification exam sample questions, please update us via email at support@certstime.com.

Try Before You Buy!

Try Before You Buy!