Sharpen Your Knowledge with CIMA (CIMAPRA19-F01-1) Certification Sample Questions

CertsTime has provided you with a sample question set to elevate your knowledge about the CIMA F1 Financial Reporting exam. With these updated sample questions, you can become quite familiar with the difficulty level and format of the real CIMAPRA19-F01-1 certification test. Try our sample CIMA F1 Financial Reporting certification practice exam to get a feel for the real exam environment. Our sample practice exam gives you a sense of reality and an idea of the questions on the actual CIMA Professional Qualification certification exam.

Our sample questions are similar to the Real CIMAPRA19-F01-1 exam questions. The premium CIMA F1 Financial Reporting certification practice exam gives you a golden opportunity to evaluate and strengthen your preparation with real-time scenario-based questions. Plus, by practicing real-time scenario-based questions, you will run into a variety of challenges that will push you to enhance your knowledge and skills.

CIMAPRA19-F01-1 Sample Questions:

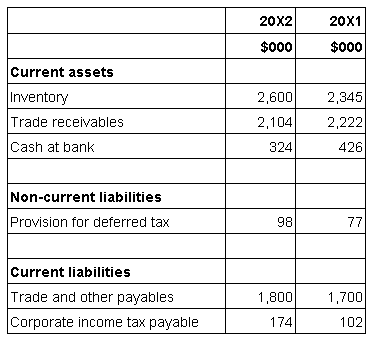

The following information is extracted from OO's statement of financial position at 31 March:

Included in other payables is interest payable of $80,000 at 31 March 20X2 and $73,000 at 31 March 20X1.

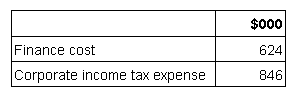

The following information if included within OO's statement of profit or loss for the year ended 31 March 20X2:

Included within finance cost is $124,000 which relates to interest paid on a finance lease. 00 includes finance lease interest within financing activities on its statement of cash flows.________________

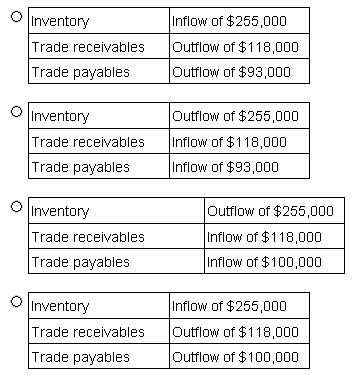

Within OO's statement of cash flow for the year ended 31 March 20X2 which figures should be included to reflect the changes in working capital within the net cash flow from operating activities?

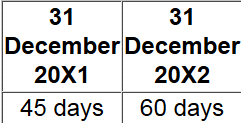

AB has been asked to analyze the receivables days of an entity with a view to improving the working capital cycle.

The following results have been produced for receivable days:

Which of the following is NOT an explanation of why the days have increased?

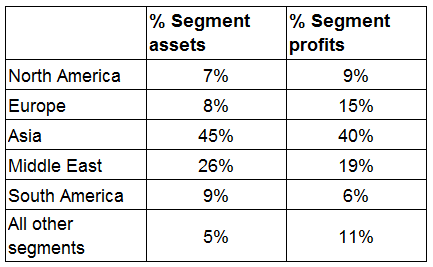

OP has five main geographic segments and reports segmental information in accordance with IFRS 8 Operating Segments.

Which THREE of the following would be regarded as operating segments of OP in accordance with IFRS 8?

An entity purchased an asset for $375,000 on 1 November 20X0 incurring legal fees of $33,000. Improvements were made to the asset for $65,000 on 1 December 20X2 which qualified as capital expenditure under the local tax rules. The entity also incurred repair costs on the asset on 1 February 20X3 amounting to $10,000.

The asset was sold for $680,000 on 1 December 20X5 incurring allowable costs on disposal of $15,000.

Indexation on the purchase cost and the improvement are allowable.

The index increased by 20% between November 20X0 and December 20X5,15% between December 20X2 and December 20X5 and 10% between February 20X3 and December 20X5

Calculate the chargeable gain on the disposal of the asset on 1 December 20X5.

A conservative policy for financing working capital is one where short-term finance is used to fund:

Note: If there is any error in our CIMAPRA19-F01-1 certification exam sample questions, please update us via email at support@certstime.com.

Try Before You Buy!

Try Before You Buy!