Sharpen Your Knowledge with AAFM (GLO_CWM_LVL_1) Certification Sample Questions

CertsTime has provided you with a sample question set to elevate your knowledge about the AAFM Chartered Wealth Manager (CWM) Global Examination exam. With these updated sample questions, you can become quite familiar with the difficulty level and format of the real GLO_CWM_LVL_1 certification test. Try our sample AAFM Chartered Wealth Manager (CWM) Global Examination certification practice exam to get a feel for the real exam environment. Our sample practice exam gives you a sense of reality and an idea of the questions on the actual AAFM Chartered Wealth Manager certification exam.

Our sample questions are similar to the Real AAFM GLO_CWM_LVL_1 exam questions. The premium AAFM Chartered Wealth Manager (CWM) Global Examination certification practice exam gives you a golden opportunity to evaluate and strengthen your preparation with real-time scenario-based questions. Plus, by practicing real-time scenario-based questions, you will run into a variety of challenges that will push you to enhance your knowledge and skills.

AAFM GLO_CWM_LVL_1 Sample Questions:

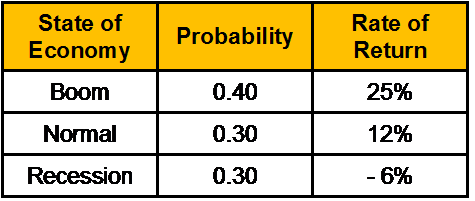

The probability distribution of the rate of return on ABC stock is given below:

What is the standard deviation of return?

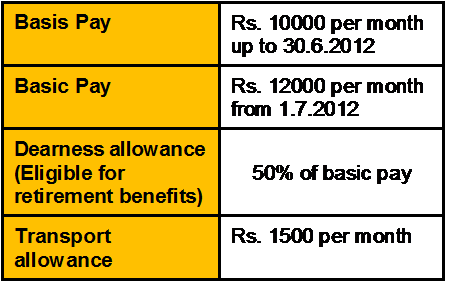

Ramesh retired as General Manager of XYZ Co. Ltd. On 30.11.2012 after rendering service for 20 years and 10 months. He received Rs. 300000 as gratuity from the employer. (He is not covered by Gratuity Act, 1972).

His salary particulars are given below:

He resides in his own house interest on monies borrowed for the self occupied house is Rs. 24000 for the year ended 31.03.2013

Compute taxable income of Ramesh for the year ended 31.03.2013.

Jaya is the owner of two residential houses. She sold one house on 23-12-2011 for Rs.12,50,000 which was purchased by her on 25-4-1979 for Rs.80,000. The market value of the land as on 1-4-1981 was Rs.98,000. Expenses on transfer were 1.5% of the sale price. The entire sale proceeds was utilized to construct the first and second floor on her second house which she completed by 15-3-2010. Compute the capital gain for the assessment year 2012-13. [CII-12-13: 852,11-12: 785, 10-11:711, 83-84: 116]

A businessman sold Rs. 85 lakh value of unlisted securities on 20th December 2012. These shares were acquired in April 2008 for Rs. 20 lakh. He invested Rs. 40 lakh from these proceeds in February 2013 in his first residential house to avail benefit under Section 54F of the Income-tax Act, 1961. What approximate amount of bonds specified under Section 54EC should he purchase and by what date so as to make his capital gains liability almost ''Nil'' towards these transactions? Cost inflation index for FY 2008-09: 582, 2012-13: 852.

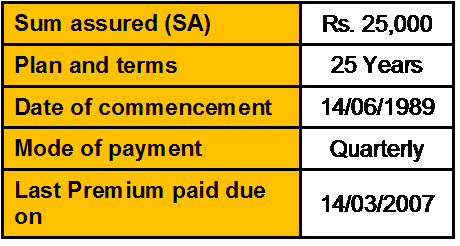

Calculate the Paid up Value ( PV) under a policy with the following particulars:

Consolidated Reversionary Bonus declared by the insurer from March, 1990 to March 2006 is 550/- per thousand sum assured. Bonus declared for the year ending March 2007 is @ Rs. 70/- per thousand.

Note: If there is any error in our AAFM GLO_CWM_LVL_1 certification exam sample questions, please update us via email at support@certstime.com.

Try Before You Buy!

Try Before You Buy!